Garden State Home Loans is your local and trusted choice for New Jersey home loan refinancing. From our office in... read more →

Garden State Home Loans is the professional team to call for New Jersey home loan information. Our office is based... read more →

Let's look at the advantages of Owning vs Renting. Purchasing real estate is a big decision that shouldn’t be taken... read more →

What started as a campaign by American Express became a national holiday when the United States Senate began recognizing the... read more →

Giving back to the community is high on our priority list at Garden State Home Loans. Since 2017, we've made... read more →

The health and safety of our clients and employees is of the utmost importance to us at Garden State Home... read more →

Q: What is the purpose of this fee? A: The Federal Housing Finance Agency (FHFA) announced that qualifying refinance transactions... read more →

Throughout COVID-19, the Garden State family continues to grow in size. Since the start of the COVID-19 crisis, Garden State... read more →

These days, our initials (GSHL) have a different meaning. Give Super Heroes Lunch. To show our support for local businesses... read more →

Stephen Oliver Joins Garden State Home Loans Cherry Hill, NJ, May 28, 2019. Garden State Home Loans is pleased to announce... read more →

The Tax Bill and Homeownership The House and the Senate have agreed on a compromise plan for the tax bill.... read more →

The Tax Bill On November 16, 2017, the U.S. House of Representatives passed a version of the act. On December... read more →

News provided by Garden State Home Loans, Inc. NMLS#473163 CHERRY HILL, New Jersey, September 8th, 2017 - Garden State Home... read more →

3D Printed Houses: An Overview Since 2000, 3D printing as a construction tool has grown across the globe. Countries including... read more →

Owned by President Donald Trump, the Mar-A-Lago private country club is highly regarded as one of the best private clubs... read more →

Understanding the Seller's Market The basic theory of supply and demand impacts housing market. As people are pursuing homeownership, there... read more →

In what might be a short-lived decision, the Consumer Financial Protection Bureau (CFPB) has moved to bar many financial firms... read more →

In a dramatic shift away from traditional monetary practices, FICO and the top credit rating agencies - Experian, Equifax, and... read more →

While many of his friends said he was boring and cheap, Stefun Darts was focused on achieving a more important... read more →

News provided by Garden State Home Loans, Inc. NMLS#473163 CHERRY HILL, New Jersey, June 20th, 2017 - After receiving over... read more →

News provided by Garden State Home Loans, Inc. NMLS#473163 CHERRY HILL, New Jersey, May 22nd, 2017 - For the third... read more →

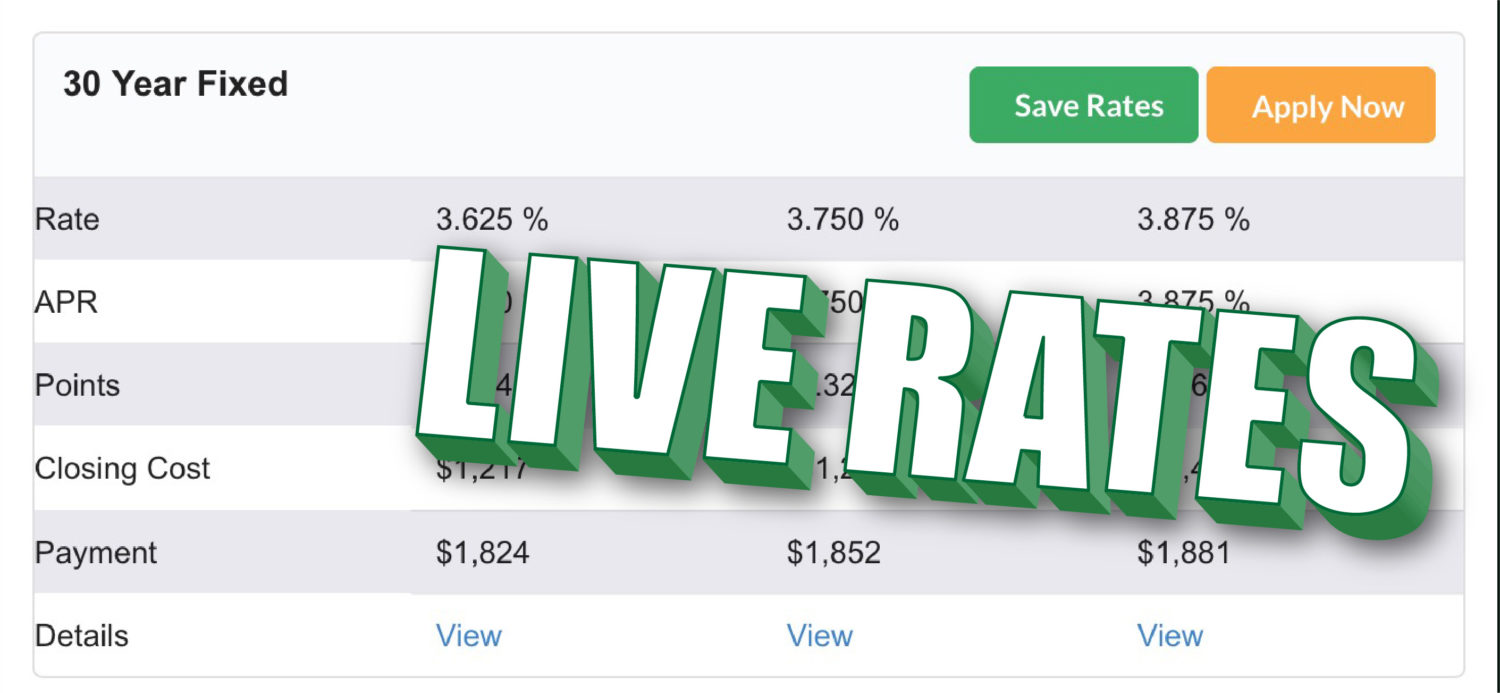

News provided by Garden State Home Loans, Inc. NMLS#473163 CHERRY HILL, New Jersey, June 20th, 2017 - Exclusive to NJ,... read more →

News provided by Garden State Home Loans, Inc. NMLS#473163 CHERRY HILL, New Jersey, May 19th, 2017 - Garden State Home... read more →

The Federal Reserve, FOMC meeting, Janet Yellen, the federal funds rate, mortgage-backed securities, rate-hike, normalization, etc. These words and more... read more →

An Overview of the Dodd-Frank Act Since the 1970s and 1980s, with the rise of financialization and investment banking, the... read more →

Garden State Home Loans Welcomes Nine New Teammates for a Summer Internship! Garden State Home Loans is proud to announce... read more →